Benchmark Construction for Endowments and Foundations

Aligning Benchmarks with Strategic Goals, Risk Tolerance & Spending Policy

1. Executive Summary

- This article highlights why common equity/bond index benchmarks often fall short for endowments and foundations and outlines how to build benchmarks that truly reflect institutional goals, risk policies, and spending needs.

- We draw on numerous industry sources with established research in this area and provide practical examples.

2. Why Standard Indexes May Be Inadequate

2.1 Limited Alignment with Institutional Strategy

- Generic benchmarks like the S&P 500 or Bloomberg U.S. Aggregate do not reflect the unique asset mix, illiquidity, or risk‐taking allowances of most endowments or foundations.

- As Archipelago Wealth Management notes, “traditional benchmarks like the S&P 500 may fall short” when portfolios include mid caps, alternatives, or ESG/impact allocations (Understanding the Power of Benchmarking in Investment Committees for Non-Profits, Endowments & Foundation. www.archipelagowm.com Feb 2025)

2.2 Misaligned Risk & Return Expectations

- Standard indices carry risk/return profiles that may diverge sharply from the organization’s policy objectives, volatility tolerance, or desired downside protection.

- For example, Citi’s review of fixed income benchmarks shows that long duration Treasury heavy indices offer stronger downside protection in stress periods—a characteristic an endowment focused on capital preservation may value more than intermediate credit benchmarks (Strategic Asset Allocation for Endowments, Foundations, and Non-Profits. www.privatebank.citibank.com Nov 2020)

3. Principles of Good Benchmark Construction

3.1 Align with the Investment Policy Statement (IPS)

Investment policy should guide benchmark construction, and benchmarks should reflect strategic intent, spending policy, and risk tolerance.

Example: An endowment with a 60% equities, 30% fixed income, 10% alternatives allocation and a 4% spending rule should build a blended custom benchmark that reflects those weights.

3.2 Custom Asset‐Class Sub Benchmarks

Instead of using broad indices, create sub benchmarks that match actual allocations—e.g. Russell 3000 for U.S. equity if large/mid/small caps are all present; a blend of MSCI ACWI ex U.S. for international; a long Treasury index or custom composite for fixed income aligned with credit and duration exposure.

For illiquid asset classes (private equity, real estate, hedge funds), consider peer group benchmarks or internal policy composites rather than public market proxies.

3.3 Reflect Spending & Liquidity Needs

A foundation with stable annual spending of 3–5% should consider building benchmarks that incorporate expected cash flows and liquidity buffers. The fixed income component might overweight high quality bonds with short term maturities relative to a pure long duration bond index.

3.4 Incorporate Risk Budget & Downside Protection

Citi research shows that long duration Treasury benchmarks offered superior performance in market downturns, even though over the full cycle all investment grade exposures had similar returns. A portfolio committed to downside protection may prefer such a benchmark.

4. Example Case Studies

4.1 University Endowment Example

- Policy allocation: 50% U.S. equity, 20% global equity, 20% fixed income (long duration Treasury blend), 10% real assets/alternatives.

Benchmark = 50% Russell 3000 + 20% MSCI ACWI ex U.S. + 20% blended IG long duration Treasury index + 10% peer group real asset composite. - If spending policy is 4% of average market value, performance should be measured net of withdrawals, and the benchmark should be adjusted to reflect that cadence.

4.2 Family Foundation with ESG Mandate

- Policy allocation: 40% global equity ESG‐screened; 30% fixed income intermediate credit; 30% impact private equity.

- Equity sub benchmark = MSCI ACWI ESG Universal.

- Fixed income = Bloomberg U.S. Credit Intermediate Composite.

- Alternatives = impact fund peer benchmark (e.g. Endowment Impact Benchmark ratings framework)

5. Governance & Reporting

Establish a formal process for periodic review of the benchmark framework, including alignment with evolving spending policy or risk tolerance.

Communicate benchmark composition clearly to stakeholders—broken out by sub benchmark weights, objectives, and performance metrics.

Use benchmarks to evaluate both internal and external manager performance fairly and transparently.

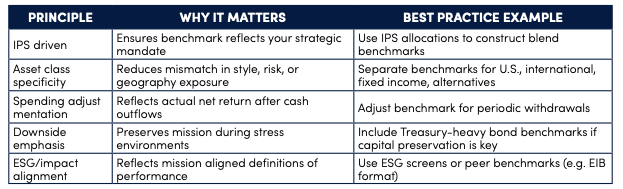

6. Best Practice Summary Table

7. Conclusion & Recommendations

Custom benchmark construction is central to fiduciary excellence and meaningful performance measurement for endowments and foundations. Benchmarks should be tailored to the overall investment and spending policy of the organization, not defaulted to broad market indices

Moving beyond default indexes to custom blends allows institutions to reflect their actual allocation, governance constraints, risk tolerance, spending needs, and impact objectives. Identifying sub benchmarks that match each asset class—and combining them into a total fund benchmark—yields clearer insights and more defensible outcomes.

Next Steps for Courier Capital Clients & Prospects:

- Review your IPS to confirm strategic allocation, risk limits, and spending rules.

- Evaluate your current benchmarks: Do they reflect your policy intentions?

- If not, work with your investment consultant to build a composite benchmark.

- Include benchmark composition in stakeholder reporting and governance reviews.

Courier Capital stands ready to help you design a benchmark framework aligned to your long-term purpose. Please reach out if you'd like to discuss how to tailor benchmarks that fit your objectives—and ensure transparency, consistency, and accountability.

References:

Gilligan, Sean P., Asset Owners: Creating Meaningful Asset Class Benchmarks That Align with Your IPS (Longs Peak Advisory Services blog, July 9, 2025) longspeakadvisory.com+10longspeakadvisory.com+10longspeakadvisory.com+10longspeakadvisory.com

Archipelago Wealth Management, Why the S&P 500 May Not Be Ideal for Endowments/Foundations Exponent Philanthropy Archipelago Wealth Management Citi Private Bank

Citi Investment Management, Strategic Asset Allocation: Fixed Income Component for Endowments & Foundations (Nov 2020) Citi Private Bank

Intentional Endowments Network, Endowment Impact Benchmark (EIB) framework and pilot results intentionalendowments.org Endowment Impact Benchmark Endowment Impact Benchmark

Courier Capital, LLC (“Courier Capital”) is an SEC registered investment adviser located in Buffalo, NY, Rochester, NY, Jamestown, NY and Pittsburgh PA. For information pertaining to the registration status of Courier Capital, as well as its fees and services, please refer to our disclosure statement as set forth on Form ADV, available upon request or via the Investment Advisor Public Disclosure Website(www.adviserinfo.sec.gov). The information contained herein should not be construed as personalized investment advice or a solicitation to buy or sell any security. Investing in the stock market involves risk of loss, including loss of principal invested, and may not be suitable for all investors. Past performance is no guarantee of future results. This material contains certain forward-looking statements which indicate future possibilities. Actual results may vary. Additionally, this material contains information derived from third party sources. Although we believe these sources to be reliable, we make no representation as to the accuracy of any information prepared by an unaffiliated third party incorporated herein, and take no responsibility therefore. All expressions of opinion reflect the judgement of the authors as the date of publication and are subject to change without prior notice. Investment products and services are not FDIC Insured, are not a deposit or bank guaranteed, are not insured by any Federal governmental agency, and are subject to investment risks, including possible loss of the principal invested.