1114 Delaware Ave

Buffalo, NY 14209

(716) 883-9595

214 West Fifth St

Jamestown, NY 14701

(716) 484-2402

100 Chestnut St – 15th Floor

Rochester, NY 14604

(585) 461-6085

1350 Old Freeport Rd

Pittsburgh, PA 15238

(412) 447-6080

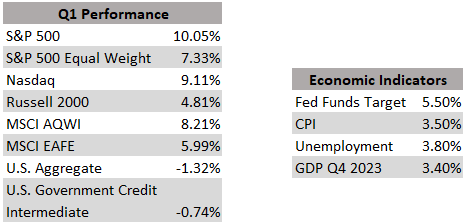

Equity markets were off to a strong start in Q1. The market cap weighted S&P 500 outperformed the equal weight index driven by the magnificent seven (Apple, Microsoft, Alphabet, Amazon, Meta Platforms, NVIDIA, Tesla). Earnings growth was also higher than anticipated. Though still trailing the U.S., international stocks fared pretty well in Q1 as well, with the MSCI EAFE was up over 5%. Bond markets slipped in Q1 with the US Agg falling over 1%. Interest rates (which are inversely correlated with bond prices) rose as inflation crept up and economic indicators posted stronger than expected results.

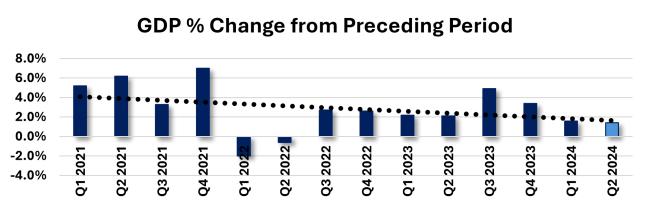

The US economy continues to look strong. The advanced estimate for GDP in Q1 2024 was 1.6%. Though growth has slowed over the past three quarters, FED forecasters expect to see growth of around 2.4% for the year. Consumer spending remains a driving force behind GDP growth. Job growth has been steady for most of Q1. In March, new jobs came in well ahead of expectations at 303,000, shifting the unemployment rate down slightly to 3.8%. Labor turnover remains low and there are still roughly 8 million job openings compared with 6.4 million unemployed. This is emblematic of a still healthy labor market, which, paired with inflation still ahead of the Fed’s target, likely means the Fed will likely wait longer to cut rates (possibly Q4). The manufacturing sector was in expansion territory in March for the first time since 2022 (as measured by the purchasing manufacturers index), another signal of robust economy.

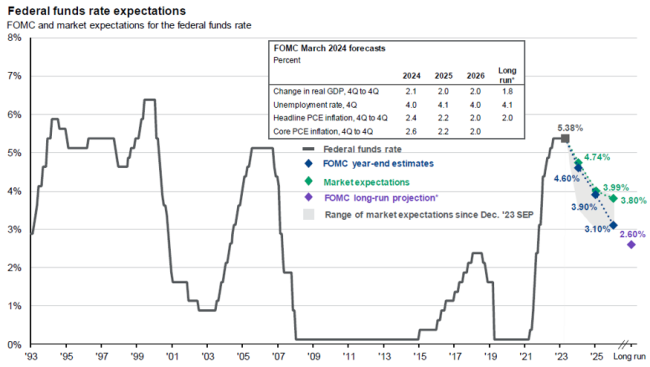

Inflation has fallen from its recent high in 2022, but remains above the Federal Reserve’s target of 2%. The Personal Consumption Expenditure (PCE), which is the Fed’s preferred method of tracking inflation, came in around 2.7% in the latest release which is up from earlier this year. Right now, consumers are primarily feeling the weight of inflation in services like travel/hospitality, airfare, insurance, and financial services. In March, the Consumer Price Index (CPI), another commonly used inflation tracker, came in around 3.5%. Similar to PCE, this is being driven by airfare, insurance, shelter, and clothing. Oil prices continue to rise and are currently over $85/barrel, which is approaching last year’s high.

Despite the reacceleration in inflation, strong labor market, and GDP growth the Fed has maintained its forecast to cut the Federal Funds Rate three times in 2024 (estimated at 75 basis points total). Chairman of the Fed Jerome Powell said: “The recent data do not ... materially change the overall picture.” At the beginning of 2024 the market anticipated rate cuts beginning around the middle of the year. However, with stronger than expected economic data releases, the Fed likely won’t start cutting rates until much later in the year if at all.

We recently surpassed the record for longest yield curve inversion. Usually, an inverted yield curve is an indicator of recession (as it anticipates lower future interest rates in response to a weaker economy), but that has not been the case with this inversion. Historically, not every yield curve inversion has been immediately followed by a recession. However, every recession is preceded by an inverted yield curve.

Courier Capital, LLC (“Courier Capital”) is an SEC registered investment adviser located in Buffalo, NY, Rochester, NY, Jamestown, NY and Pittsburgh, PA. Registration does not imply a certain level of skill or training. For information pertaining to the registration status of Courier Capital, as well as its fees and services, please refer to our disclosure statement as set forth on Form ADV, available upon request or via the Investment Advisor Public Disclosure Website (www.adviserinfo.sec.gov). The information contained herein should not be construed as personalized investment advice or a solicitation to buy or sell any security. Investing in the stock market involves risk of loss, including loss of principal invested, and may not be suitable for all investors. Past performance is no guarantee of future results. This material contains certain forward-looking statements which indicate future possibilities. Actual results may differ materially from the expectations portrayed in such forward-looking statements. As such, there is no guarantee that any views and opinions expressed in this material will come to pass. Additionally, this material contains information derived from third party sources. Although we believe these sources to be reliable, we make no representation as to the accuracy of any information prepared by an unaffiliated third party incorporated herein, and take no responsibility therefore. All expressions of opinion reflect the judgement of the authors as the date of publication and are subject to change without prior notice. Investment products and services are not FDIC Insured, are not a deposit or bank guaranteed, are not insured by any Federal governmental agency, and are subject to investment risks, including possible loss of the principal invested.